AGENTIC AI PLATFORM FOR ENTERPRISE

Intelligent Agents Running Your Business

The next-generation intelligent ecosystem for insurance and financial services. Deploy AI agents that automate submissions, claims, compliance, and trading—24/7 precision, zero manual work.

THE CHALLENGE

Insurance Workflows Drowning in Busywork

The insurance business depends on unstructured data flows. Underwriters navigate large sets of non-standardized submission documents, resulting in slow, manual workflows with significant time spent on data entry.

UNSTRUCTURED DATA CHAOS

Underwriters routinely navigate large sets of non-standardized submission documents from brokers, requiring manual data extraction and entry into multiple systems.

Impact: 1-2 weeks per submission

INCONSISTENT RISK ASSESSMENT

Teams are forced to pull required fields from submissions and upload them into several core systems, making it difficult to apply uniform review processes across all submissions.

Impact: Expensive, ineffective underwriting

BUSINESS IMPACT

UWs become bogged down in workflow steps that take time away from true underwriting and broker engagement, negatively affecting customer satisfaction and new business conversion.

Impact: Lost revenue & market share

CORE PLATFORM

Imaginist Agentic AI Studio & Platform

A secure enterprise AI software provider delivering comprehensive tool sets and services to create intelligent enterprise-scale AI applications, integrations, and collaborative workflows more efficiently.

AGENTIC STUDIO

Build, test, and deploy AI agent teams. Create specialized agents, connect them into teams, and deploy agentic applications through workflows and business rules—all with intuitive visual controls.

- No-code agent creation

- Team orchestration

- Workflow automation

WORKFLOWS & NATIVE AI APPS

Build, test, and deploy AI agent teams. Create specialized agents, connect them into teams, and deploy agentic applications through workflows and business rules—all with intuitive visual controls.

- Insurance-specific apps

- Finance-specific apps

- Custom approval flows

ADAPTIVE UX & CUSTOMIZATION

Build, test, and deploy AI agent teams. Create specialized agents, connect them into teams, and deploy agentic applications through workflows and business rules—all with intuitive visual controls.

- Low-code UX Cards

- Custom data fields

- Business rules engine

ENTERPRISE-GRADE CAPABILITIES

OCR & Data Extraction

Advanced optical character recognition powered by vision-language models. Extract data from diverse document formats with exceptional accuracy, turning unstructured content into actionable insights.

Self-Learning Intelligence

AI that evolves with your business. The platform continuously learns from company-specific workflows, adapts to changing business rules, and improves accuracy over time.

No-Code Configurability

Configure core functionality without writing code. Leverage unified data models, intuitive UI, and ML capabilities through business process management and rules engines.

Enterprise-Grade Security

Comprehensive data protection built into every layer. Features include guardrails, end-to-end encryption, granular permissions, and full regulatory compliance.

Complete Observability

Real-time visibility into every aspect of operations. Monitor system health, track agent performance, analyze API usage, and oversee workflow execution.

Granular Permissions & Audit

Customer-specific permission layers, custom role management, and comprehensive audit trails for full transparency and regulatory compliance.

INSURANCE PRODUCTS

Intelligent Insurance Transformation

Deploy intelligent insurance process agents that handle submissions, claims, compliance, and underwriting with surgical precision and 24/7 availability.

Business as Usual

Stage 1: Submission Intake

Manual review and decision-making

Stage 2-4: Research & Triage

Manual data extraction, multiple system entries, inconsistent review

Stage 5: UW Assessment

Manual review and decision-making

1-2 weeks

Elapsed time per submission

Business with Ai

Submission Intake

Auto-extracted data, reduced support dependency

Quick Triage

GenAI applies rules, aggregates external data

Advanced Triage

GenAI delivers clean summary with bind

probability

Less than 1 day

Elapsed time per submission

SETTLE CLAIMS FASTER

75%

Cut underwriting cycle time by unifying data, automating intake, and performing quick/advanced triage

THROUGHPUT

5X

Improve submission-to-bind conversion from 25% to ~30%, cut time-to-quote to one week

REVIEW CONSISTENCY

100%

Guarantee uniform submission diligence and streamline review through automation

BROKER EXPERIENCE

+30%

Quicker quoting improves broker relationships and sends positive competitive signals

Insurance Product Suite

Document Processing

NLP-powered document parsing and classification. Automatically categorize, extract, and structure data from submissions, claims, and policy documents.

Accuracy: 99.8%

Claim Automation

AI-driven claims routing, validation, and processing. Straight-through processing with intelligent handoff to underwriters for complex cases.

80% straight-through processing

Voice FNOL & STP

Voice-enabled First Notice of Loss with automatic routing and intelligent processing. Seamless integration with legacy systems and real-time claim validation.

24/7 availability

Submission Intake Processing

Realtime risk profiling and triage with intelligent underwriting guidelines applied automatically. Every submission gets consistent, thorough review.

Settle Claims

60%

Reduce complaints

Go Touchless

80%

Straight-through

Win Business

40%

Productivity boost

Scale Effortlessly

∞

No delays

Why Imaginist Agentic AI Platform?

Insurance-Specific Intelligence

Built on comprehensive insurance-specific data models designed for the entire policy and claims lifecycle—from first notice of loss to policy endorsements, claims adjudication to underwriting submissions. No other platform delivers this depth of insurance-native intelligence.

Precision Data Processing

Achieve exceptional accuracy in converting unstructured claims and submission data into structured fields. Our insurance-specific data models combined with multi-modal AI architecture—including language models, vision models, and layout recognition with contextual validation—ensure reliable outputs.

AI Agents That Work Like Your Team

Imaginist AI agents emulate claims handlers and underwriters, autonomously performing intake, processing, and validation tasks. They read policy documents, analyze claims files, assess damage photos, and execute decisions just like your experienced professionals.

Adaptive Learning & Collaboration

The platform employs advanced agentic workflows with reinforcement learning to continuously improve performance on organization-specific tasks—from claims approvals and fraud detection to data extraction and policy validation.

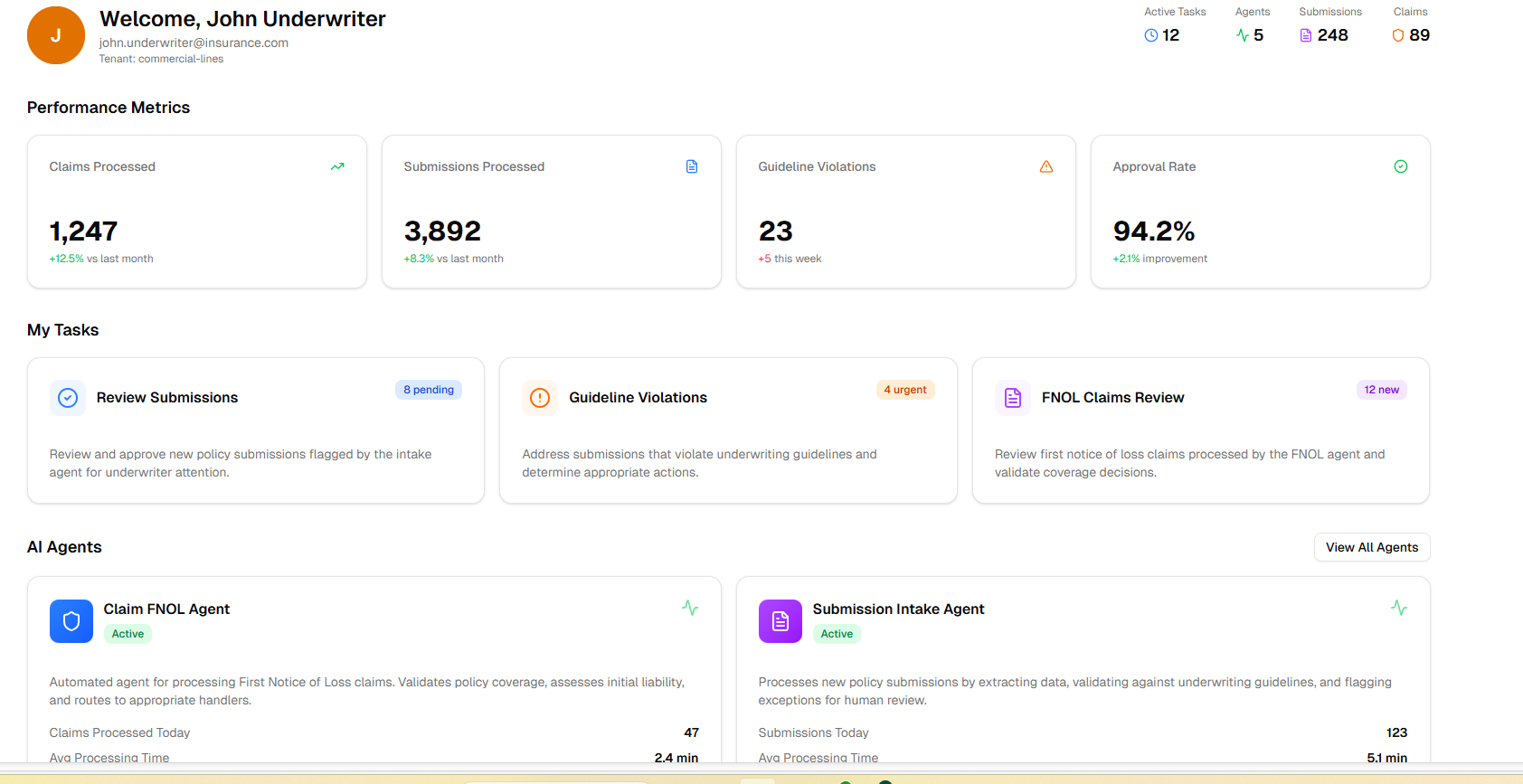

1,247 claims processed

with 94.2% approval rate

3,892 submissions processed

in real-time

100% consistency

Across all submissions

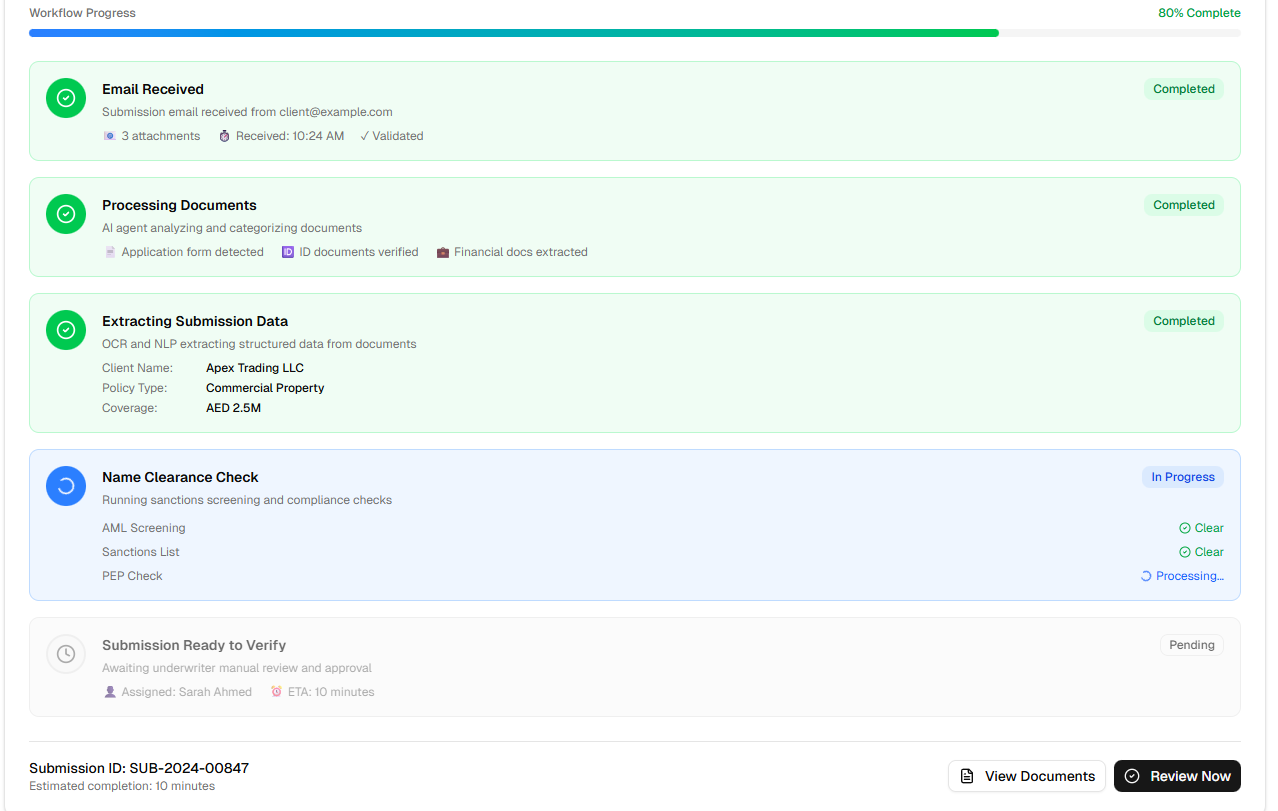

Real-time submission processing workflow with automated status tracking

AI Agents That Transform Insurance & Finance

Automated Submission Intake

Agents automatically receive, analyze, and categorize incoming submissions, extracting all required data instantly using advanced OCR and NLP.

Intelligent Document Processing

OCR and NLP technology extracts structured data from application forms, ID documents, and financial records with 99.8% accuracy.

Compliance & Risk Screening

Run AML screening, KYC verification, PEP checks, and sanctions list validation—all automatically and in real-time.

Smart Underwriting Assistant

GenAI applies underwriting guidelines, analyzes risk, and delivers actionable summaries with bind probability scores.

Complete AI Agent Ecosystem

Insurance Agents

Submission Intake Agent

Automates email intake, document categorization, and instant data extraction from policy submissions. Applies underwriting rules automatically.

Compliance Agent

Runs comprehensive sanctions screening, AML checks, and compliance validation against regulatory databases in real-time.

Claim FNOL Agent

Handles first notice of loss processing, claim routing, and validation. Provides straight-through processing for routine claims.

Financial Services Agents

Remittance Processing Agent

Automates money transfer validation, recipient verification, and processing across 140+ countries with real-time compliance checks.

Forex Trading Agent

Monitors currency markets, executes trades, and manages corporate FX transactions in real-time with competitive rates.

Gold Loan & KYC Agent

Processes loan applications, validates collateral, manages KYC verification, and handles gold loan processing automatically.

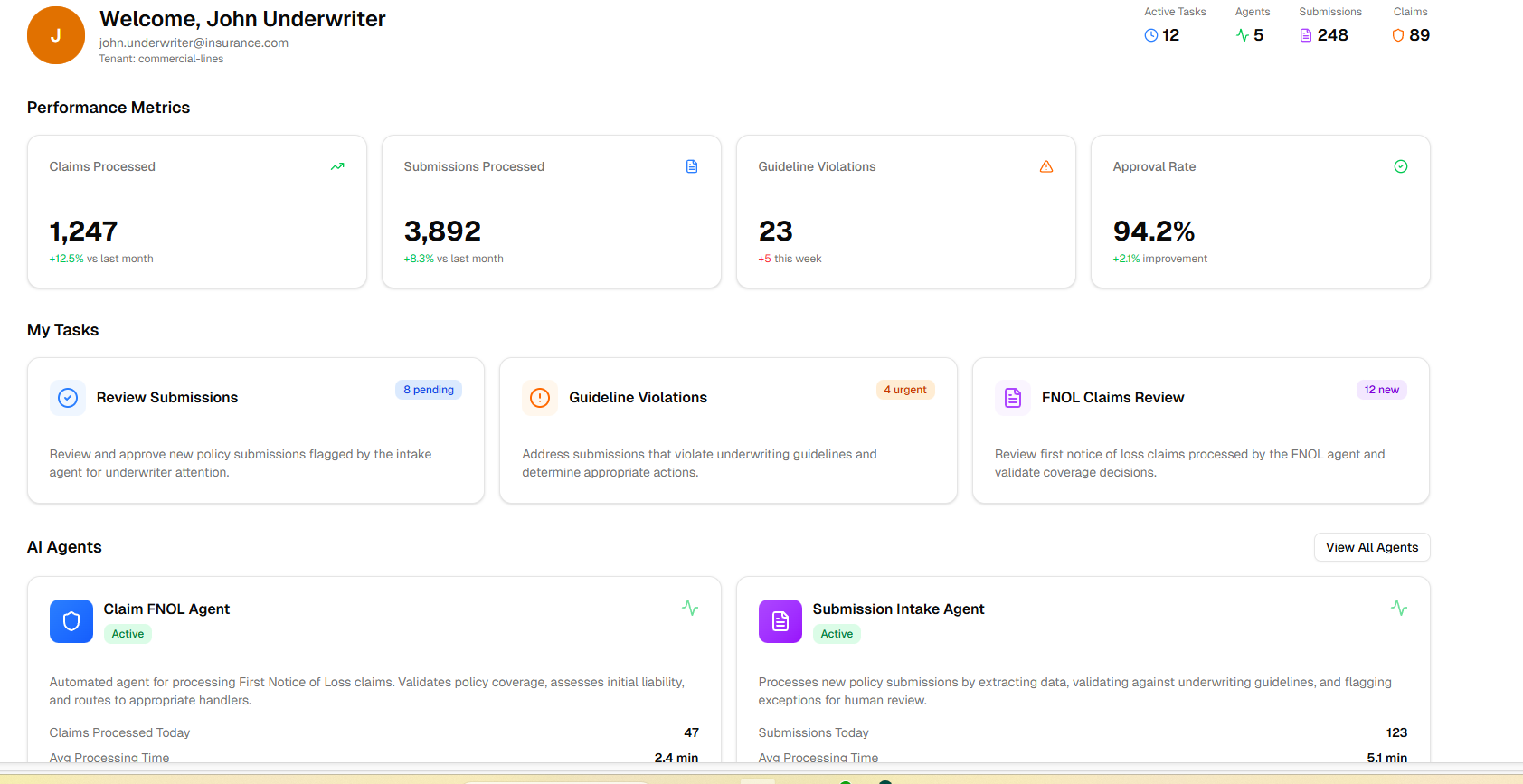

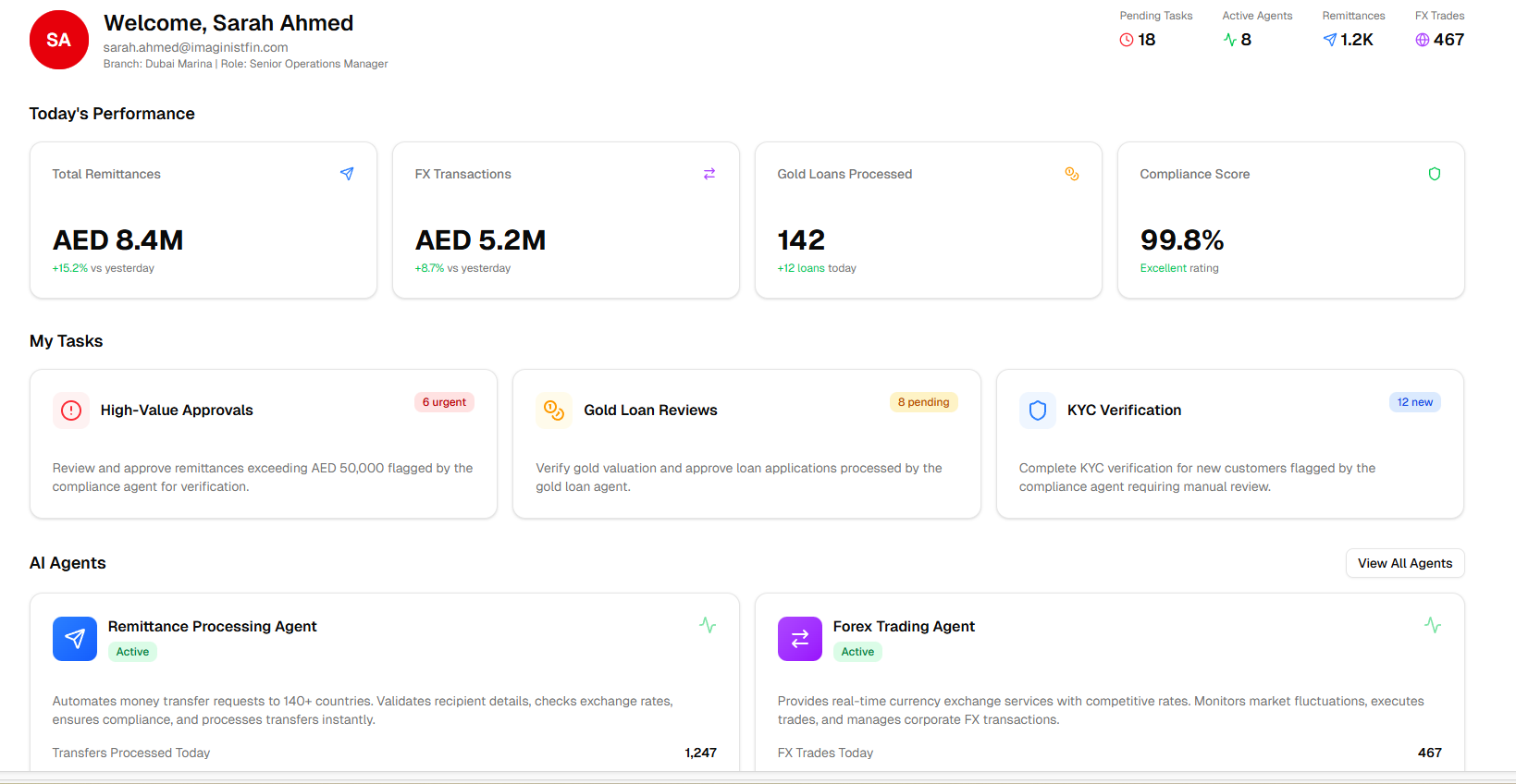

Live Platform Performance

Insurance Underwriter Dashboard

Submission Intake Agent

- 1,247 claims processed

- 3,892 submissions processed

- 94.2% approval rate/li>

Financial Services Dashboard

Remittance Processing Agent

- AED 8.4M remittances processed

- 99.8% compliance score

- 142 gold loans processed

Ready to Transform Your Workflows?

Join insurance and financial services leaders automating complex processes with intelligent AI agents. Start your free trial today.